Contents:

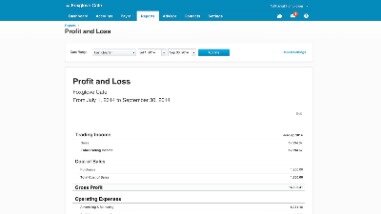

What happens when a business needs to record a transaction in QuickBooks, but can’t find a matching account name in the chart of accounts? QuickBooks allows you to make up a new account name which you think better fits the transaction description. Unfortunately, this practice tends to spiral out of control. Revenue accounts are the income a business receives from the sale of its products or services.

QuickBooks Online Pricing And Plans (2023 Guide) – Forbes Advisor – Forbes

QuickBooks Online Pricing And Plans (2023 Guide) – Forbes Advisor.

Posted: Tue, 28 Feb 2023 08:00:00 GMT [source]

Thus, if you change the employee status instead of deleting it on QuickBooks, the profile and pay records remain in your accounting database without any data loss in your tax payments. Dancing Numbers is SaaS-based software that is easy to integrate with any QuickBooks account. With the help of this software, you can import, export, as well as erase lists and transactions from the Company files.

Three more icons to the right or the search bar allow you to do batch editing, print the chart, and change settings. The pencil icon for batch editing makes every name field in the chart editable. The printer icon allows for printing or exporting into another format like PDF.

The value of common stock is equal to the par value of the shares times the number of shares outstanding. For example, 1 million shares with $1 of par value would result in $1 million of common share capital on the balance sheet. Equity is the amount funded by the owners or shareholders of a company for the initial start-up and continuous operation of a business. Total equity also represents the residual value left in assets after all liabilities have been paid off, and is recorded on the company’s balance sheet. To calculate total equity, simply deduct total liabilities from total assets. It is used to provide an offset to the other accounts, so that the books are always balanced.

Accrual basis opening accounts payable transactions as of the start date. Opening balances for other Balance Sheet accounts created in the Add New Account dialog box. The usual cause of inventory adjustments posting to this account is when new items are created with an on hand quantity and total value .

Owner’s equity in a partnership

The first way is to click the gear icon in the Header at the top-right of the screen. From there, you can access the chart of accounts under the Your Company heading. A journal entry can be used in a number of ways to close this account for you or your bookkeeper. You must enter the opening balance in the account register after any transactions have been made. These are the profits that the company’s owners have not yet shared.

- https://maximarkets.world/wp-content/uploads/2020/08/forex_education.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/Platform-maximarkets-1.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/MetaTrader4_maximarkets.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/logo-1.png

- https://maximarkets.world/wp-content/uploads/2020/08/forex_team.jpg

The company had transactions prior to the QuickBooks start date (i.e., it is not a new business). If it is a new business with no prior transactions, then simply begin entering typical QuickBooks transactions with no need for unusual start up entries. This option groups the report by type of transaction, which might make reviewing the source of the transactions easier.

How to use QuickBooks Opening Balance Equity ?

It is instead retained for reinvesting in the business or to pay off future obligations. Hopefully, at this point, you are ready to start understanding and fixing opening balance equity in QuickBooks yourself. Furthermore, using Dancing Numbers saves a lot of your time and money which you can otherwise invest in the growth and expansion of your business.

It’s just when the business is kind of an extension of yourself and you’re taking money from the business, this is not salaries or dividends. And if you wanted to know the best way to take money from your business, definitely talk to your accountant. But if you have an owner’s draw and you know what that is, and you’d like to know the best way to record it in QuickBooks, watch on. Keep in mind that this account will continue to increase over time.

Common mistakes to Avoid

You can refer to Equity as the book value of an organization, which might vary with its market value. From the drop-down menu click From account and then select the owner equity account. After doing this, click on Save and Close button, to record the Members Equity deposit. In this context, it’d likely be the open balance equity account.

If you choose to make this a sub-account, then select the parent account from the dropdown menu. The chart of accounts is a listing of where all the money flows in your company. It will let you know when you spent money and what it was on.

When doing bank reconciliation, be certain that the bank statement balance transaction accounts for unpaid bank checks and other issues. The best practice is to close opening balance equity accounts off to retained earnings or owner’s equity accounts. Once the account entry process is completed for all accounts, compare the total opening balance equity to the sum of all beginning equity accounts listed in the prior account balances. If the balances match, then the initial entry of accounts was accurate. If not, then review the initial account balances entry to see if there was a data entry error. If your accountant generates periodic financial statements for your business, you may have noticed equity accounts on the balance sheet or seen a statement of equity.

Inventory total value balances entered in the New Item dialog. As a result, if you create a new asset account with a balance, you must usually offset it by the same amount on the other side of the equation. You can make an account inactive so that your books are neat and orderly. This won’t delete the account information and transactions, so you can keep a record of it. The columns are name, type, detail type, QuickBooks balance, bank balance, and action. The chart can be sorted in ascending or descending order by name, type, or balances.

Owner’s draws, conversely, are transactions that involve taking money out of your business. Although they are called “equity accounts,” they contain both types of transactions. You can find owner’s equity or investments and owner’s draws listed in an equity account.

Education and empathy are essential to equity – Strategy Online

Education and empathy are essential to equity.

Posted: Mon, 06 Mar 2023 16:33:22 GMT [source]

To review your file data on the preview screen, just click on “next,” which shows your file data. In the Delete process, select the file, lists, or transactions you want to delete, then apply the filters on the file and then click on the Delete option. After that, apply the filters, select the fields, and then do the export.

Quickbooks will require you to enter some details about the new equity account. After adding these details, click “Save & Close” to complete the process. Sometimes corporations want to downsize or eliminate investors by purchasing company from shareholders. These shares that are purchased by the company are called treasury stock.

In this lesson, we will take an in-depth look at this important feature of how to integrate credit card processing into xero Online. To make your balance sheet look more streamlined and professional, remove the balance in this account. Beginning equity balance Short-term use of QuickBooks is recommended. To maintain the balance of the journal entries, use the Opening Balance Equity account as the offset account. A dividends paid account to track the amounts distributed to shareholders in the current year.

- https://maximarkets.world/wp-content/uploads/2021/06/platform-maximarkets-4.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/Platform-maximarkets-2.jpg

- https://maximarkets.world/wp-content/uploads/2021/06/platform-maximarkets-all.jpg

- https://maximarkets.world/wp-content/uploads/2021/06/platform-maximarkets-5.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/forex_trader.jpg

First of all, Click the Import available on the Home Screen. For selecting the file, click on “select your file,” Alternatively, you can also click “Browse file” to browse and choose the desired file. You can also click on the “View sample file” to go to the Dancing Numbers sample file. Then, set up the mapping of the file column related to QuickBooks fields.

This records a draw from farm business capital for personal items–it reduces the equity total reflected in your accounts. Once the system is balanced, you will be able to move opening balance equity in QuickBooks to other equity accounts, like retained earnings and common stock. Assume an asset account, such as a checking account, with a balance of $100 is added to accounting software. Another account must be affected by $100 in order for your balance sheet to be balanced.

This interface of https://bookkeeping-reviews.com/ is very easy to follow and you are led with the help of prompts as well. In case, you still need help at any time, you can always give us a call, who are renowned experts of this financial accounting platform. Backed with in depth knowledge of our personnel, we can offer you the experts and you can rest assured for all the finance related calculations. At Dancing Numbers, we understand your specific business requirements can vary and we are committed to provide you the best suited resolution for your business. Enter the amount of the equity in the “Decrease” column to send the equity from an existing balance to your Retained Earnings account. Otherwise, enter the amount in the “Increase” column to increase your equity.